Contents

Out with the old, and in with the new. Here’s a look back at the wild ride that was Bitcoin in 2020.

As we turn towards our favorite apps like Spotify to tell us all the tunes we blared this year, Instagram shows us our favorite pictures, and Facebook creates a short clip that is often filled more with memes and less with memories- Bitcoin also deserves a wrap-up.

2020 was a whirlwind. Good or bad, this year was indeed one for the books. In the realm of Bitcoin, though, the landmark 52 weeks that comprised 2020 held some pretty incredible upsides. New users flocked to platforms like Bitvavo, exchanges designed for the crypto-illiterate as times got tough. Institutional interest, the heavy hitters that could quickly lose a few grands amidst a pandemic, also sucked up any loose bitcoins that hit the trading floor. Bitcoin had a spectacular year, even if yours wasn’t so great. So, we’d like to take a minute and bask in the positivity as we wrap up all of the blockbuster moments of Bitcoin’s 2020 in the review.

February

In February, the crypto space was abuzz with all of the intensity and excitement that seeing the coin hit $10k would soon bring. Following the skyscraping (and mere moments long) hit at $20k in 2018, bitcoin had struggled to hit five digits since. However, February promised investors new heights as the coin finally regained that epic milestone.

March

Sadly, it wasn’t long before the well-loved crypto shrugged off its Valentine’s Dayglow, and by March, the coin plummeted to a rock bottom price that hadn’t been seen since early 2019. However, most investors weren’t shaking- as it wasn’t just bitcoin that was experiencing these bottom-out blues, but the entire stock market as a whole. Signaling the beginning of the COVID-19 market crash would take many investment months to bounce back from- if they did at all.

May

But, bitcoin investors and enthusiasts held on to their unrequited positivity, quietly holding their breath to see what May’s halving might bring. A strong rally has always followed an event that happens only once every four years. So even new retail investors took to the internet in hopes to get in on the newly shook out liquidity and snag their chance at the investment of a lifetime.

July

By July, it became evident that the vigorous enthusiasm had paid off. Bitcoin had made a strong comeback, well in advance of most other legacy stocks. Once again, the coin promised to break the $10k band finally, and this time the bubble looked more like a hot air balloon- durable and ready to set sail into the sky. Bitcoin’s famous price volatility seemed to be waning as, throughout the summer, prices brought a steady incline- reassuring investors of a more reliable future.

August

By August, more stable prices and gentle gains had even big-time retail investors believing in the coins staying power. As more institutional investors began to interest in the bitcoin space, their analytical prowess provided better data, giving top investment tips to all and further bolstering confidence and adoption. Political turmoil- particularly in the US- really started to heat up, making the concept of decentralized currency ever more practical for those feeling the pressure of faltering governmental policy and inflationary practice.

October

By October, the likes of Visa, MasterCard, and PayPal had entered the crypto space. With each of the financial mega-giants revealing that they would begin providing infrastructure to better support crypto payments and trading. Where all three had set their sights on Bitcoin specifically. Taking the entire financial world with them. Ethereum’s DeFi structures offered a familiar landscape for investment firms and payment platforms alike- with companies like JP Morgan now publically backing the coin as part of a healthy and diversified portfolio.

November

By November, Bitcoin had finally pushed through its 18k resistance band and began to reach for that hair above $20k that would put it at it’s highest price ever recorded. It came frustratingly close, within $200. But this did little to deter determined investors and newfound proponents. Media outlets began to champion the coin, even after tumultuous histories of long eschewed criticism. It seemed as though the entire world began to rally around the promise that crypto had been building for more than a decade.

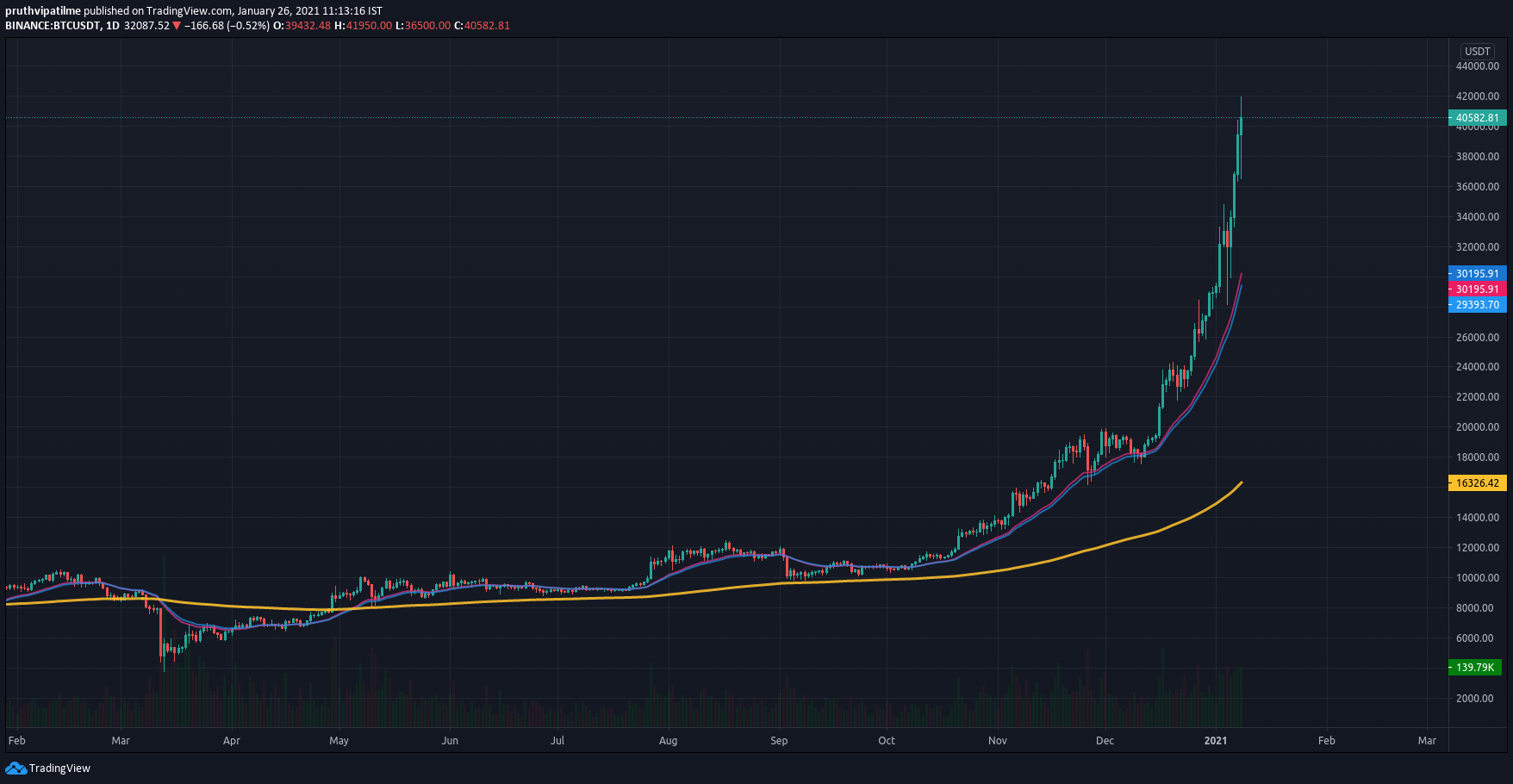

January, Again

Come December, BTC exploded. It was shattering the record highs seen in 2017 and continuously reaching higher with a massive spike pushing through the fabled $25k hurdle, the coin shot up seemingly overnight. It was continuing this trajectory and momentum into the new year. On Thursday, December 7- the beloved crypto opened at $36,843.67 and saw a jaw dropped high of $40,114.68. Which has many wonderings just how high the coin will go and exactly where it will take us in the future.