There are a lot of terms in the world of cryptocurrencies. Some are extremely technical, while others are just “aboriginal” to the crypto community. To understand cryptocurrencies better, you need to know these terms.

If you are looking for a glossary of cryptocurrency terms, you are at the right place.

Without further ado, let’s discuss the heavily used terms in the field of cryptocurrencies.

Contents

TECHNICAL TERMS RELATED TO CRYPTOCURRENCY

In this section, I am going to list some of the popular technical terms regarding cryptocurrencies. These are definitions of Cryptocurrency terms for beginners –

1. BLOCKCHAIN

The blockchain is a type of data structure that originated with the first cryptocurrency ever – Bitcoin. You can view a blockchain as a linear chain-like structure that contains a set of records. And in the case of a cryptocurrency, this set of records gradually increases.

The records on a blockchain are called blocks. Each and every block on the blockchain is linked to its previous block. Thus the name “blockchain”.

What makes blockchain different than many other data structures is its decentralization. A single person or entity does not control the blockchain or owns it. Instead, a set of computers create and control this blockchain.

The cryptocurrency industry is the pioneer in the blockchain industry. The blockchain technology allows creating a decentralized public ledger for a cryptocurrency. This public ledger is accessible by everyone.

But this does not make the blockchain any less secure than an enterprise database because the blockchain is enabled and protected through cryptography.

2. BLOCK

A block is the basic unit of data in a blockchain. A blockchain is a collection of blocks placed linearly.

These blocks contain transaction data in hashed format. These transaction data is collected from a set of transactions that happened in a set time period. So blocks are also not generated continuously. Instead, they are also generated after a period of time after collecting the transaction data.

Mining nodes generate these hashed blocks. And once the cryptocurrency network accepts a block, it adds the block to the blockchain. Once the network attaches a block to the blockchain, it resides there for the entirety of the network’s lifespan.

3. CRYPTOCURRENCY WALLET AND ADDRESS

A wallet is where you store your funds or cryptocurrency units. It can either be software-based or hardware-based. Generally speaking, hardware-based wallets are far more secure than software ones.

Cryptocurrencies are decentralized digital currencies. So there is no centralized authority to handle your funds. That is why you yourself need to become your own banker essentially.

Some popular multi-currency software wallets are Exodus, CoinPayments, etc. In my opinion, the best hardware wallets are Ledger Nano S and Trezor.

You can identify one wallet from another using the wallet address. You can imagine it being the equivalent of account numbers in the case of traditional banking. But unlike bank account numbers, which are completely numerical, these wallet addresses are alphanumerical. Example of a Bitcoin wallet address – 1GVY5eZvtc5bA6EFEGnpqJeHUC5YaV5dsb.

4. PUBLIC KEY & PRIVATE KEY

Public and private keys are concepts of cryptography. A public key is a known cryptographic key. Anyone can utilize this key to encrypt a message or some information. And then they can send it to someone else.

To decrypt the message, the receiver needs to use a key that is only known to them.

A wallet address is the public portion of two encrypted keys. These encrypted keys are essential for accepting and verifying transactions.

5. SIGNATURE

Just like your signature can verify your identity in some cases, cryptographic signatures also verify one’s identity.

Cryptographic signatures are mathematical operations. Which makes them extremely secure and no one can uncover them.

In the case of cryptocurrencies, only a valid signature can prove your sole ownership of your wallet address and your funds.

This is the private key – only you know this private key and can use this to authorize transactions. The only way someone can access your private key is if you are dumb enough to show it to them.

6. GENESIS BLOCK AND BLOCK HEIGHT

The first block on the blockchain of any cryptocurrency is called the genesis block. The genesis block holds the first few transactions to happen on a particular cryptocurrency. Oftentimes the genesis block contains a special coinbase message.

For example, in the case of Bitcoin, the coinbase parameter of the genesis block reads –

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

The block height is a metric to realize how many blocks precede a certain block. If a block has a block height of 10, that means there are ten blocks before it on the blockchain. The genesis block has a block height of 0, as it is the inception block.

7. MINING

Mining is an essential and inevitable part of a cryptocurrency, well, for a mineable cryptocurrency at least. You see there is no centralized authority in a cryptocurrency network. But we need someone to verify the transactions for us, right?

And this is where miners or mining nodes come into play. Miners are special nodes in a cryptocurrency network. Their main task is to verify transactions and add them to the blockchain. But the process is not as easy as it sounds.

As I mentioned earlier, a cryptocurrency network generates blocks after a certain period of time. For Bitcoin and many other cryptocurrencies, this period is of ten minutes. So the network collects and keeps track of every transaction happening during this period.

After that, the network announces the transactions to the miners. Then the miners start hashing the transaction to produce a block. But the cryptocurrency network does not accept any block. It only accepts a block that meets a certain criterion. And this criterion randomly changes with every block, so there are no ways to guess it beforehand.

So the miners race against each other to find the suitable hash for the transactions. The network rewards the miner who succeeds in finding a suitable hash.

For a mineable cryptocurrency, mining is also the only way to create new units of that cryptocurrency. That is why mining is critical.

8. BLOCK REWARD

As I have mentioned above the cryptocurrency network rewards the miner which finds the suitable hash for a certain block. And we call this reward the block reward.

The cryptocurrency network presets the block reward. So it is usually different for different cryptocurrencies. The block reward also decreases over time to control the circulation of currency units. Because unlike traditional currencies, cryptocurrencies have a fixed unit of coins that can ever exist.

For example, in Bitcoin, the protocol halves the block reward after every 210,000 blocks, which happens approximately every four years. We call this process, “halving.” Currently, the block reward for Bitcoin is 12.5BTC per block.

9. MINING POOL

You can mine a cryptocurrency in two ways. You either mine it alone (solo mining) or you mine with a group of miners (pooled mining). A mining pool allows you to contribute your mining power in exchange for a part of the block reward.

Mining pools employ a lot of methods to share the earnings among the miners. They can use simple PPS or more advanced PPLNS etc.

10. NODE

A node is a computer or system connected to the network of a cryptocurrency, be it Bitcoin, Ethereum, Litecoin, etc. It supports the cryptocurrency network by relaying transactions and validations. Nodes help a cryptocurrency become more decentralized. Nodes also have a full copy of the entire blockchain locally available.

11. HASHRATE

When it comes to cryptocurrency mining, hashrate is a very important term. The term hashrate means the amount of hashing a particular hardware can do usually per second.

This is a metric to measure the performance of particular hardware; be it an ASIC, a GPU, or CPU. Hashrates change depending upon the hardware. Also, the same hardware will produce different hashrates while mining different cryptocurrencies, considering the hashing protocols are different.

But for cryptocurrencies that use the same hashing protocol, the hashrate of particular hardware is fairly constant. For our own benefit, we have created a unit called “hash per second” to define hashrate. For example, while mining Cryptonight based cryptocurrencies, a Vega 56 can achieve a hashrate of 1900 h/s.

There are also bigger units like Kh/s (Kilohash), Mh/s (Megahash), Gh/s (Gigahash), Th/s (Terahash), and even Ph/s (Petahash)! Antminer S9 ASIC miners for Bitcoins usually have hashrates around 14Th/s. At the same time, large mining pools have combined hashrates of several Pethash per second.

12. ASIC

ASIC stands for Application-Specific Integrated Circuit. ASICs are special hardware that can do only a specific task with great effectiveness.

Bitcoin and many other cryptocurrency mining entered a new race when ASICs came into play. These mining rigs are extremely effective and more powerful than a traditional GPU or CPU based mining rig. Because the labs made these solely for one reason – mining a specific cryptocurrency.

As I discussed earlier, mining is nothing but solving intense cryptographic puzzles. And ASICs are made to solve these problems at a great pace. ASIC miners are very expensive because of their specialized nature. Some of the most popular ASIC mining rigs are Antminer S9, Antminer L3+, Antminer D3, Dragonmint 16T, etc.

Some popular cryptocurrencies like Bitcoin, Litecoin, Dash, etc., support ASIC mining. But the current generation of cryptocurrencies usually does not entertain ASIC mining because it makes mining difficult for common people.

13. ALTCOIN

Altcoin is the amalgamation of the terms – alternate and coin. An altcoin is a cryptocurrency that is not Bitcoin. So Ethereum, Litecoin, Ripple etc are all altcoins.

Bitcoin, being the first cryptocurrency, enjoys the royal treatment among all the other cryptocurrencies. And cryptocurrency enthusiasts usually keep Bitcoin in a class of its own. That is why the term altcoin came into being.

14. SMART CONTRACT

A smart contract is a digital equivalent of the real world contract. But while the real world contract depends upon law, programmers enforce smart contracts using cryptographic code. A smart contract can carry out certain tasks only after certain logical conditions are met.

Once you define a smart contract, you cannot alter it anymore. Because by definition, smart contracts are unalterable. Contrary to general belief, Bitcoin does support smart contracts.

But smart contracts on Bitcoin are fundamental and depend upon transfer of value. In contrast, modern cryptocurrencies like Ethereum have implemented smart contracts more effectively.

15. MULTISIG

Generally, only a single person or entity controls the private key or signature of a cryptocurrency wallet address. So this individual has all the necessary powers to authorize transactions. But there may be scenarios where more than one entity is needed to authorize a transaction.

For example, a company may start accepting Bitcoin or any other cryptocurrency. If only one person controls the wallet, it can be quite risky for the company. That is why we need the multisig or multi-signature.

The multisig feature allows us to use multiple signatures to authorize a transaction. This is an extra layer of security.

16. POW AND POS

PoW and PoS are two very important terms regarding cryptocurrencies. These two are not only two terms, they also define how a cryptocurrency works. PoW and PoS also happen to be the most basic category division between cryptocurrencies.

PoW stands for Proof of Work. This means for verifying transactions; a node needs to perform certain Proof of Work puzzles. A cryptocurrency that employs PoW means it is a mineable cryptocurrency.

On the other hand, PoS stands for Proof of Stake. Instead of miners in the case of a PoS cryptocurrency, there are validators. These validators decide whether a transaction is valid or not by distributed consensus.

17. P2P

P2P is the abbreviated form of the term peer-to-peer. Peer to peer technology allows two or more person, devices, nodes etc to connect with each other without the help of some third party. So without the interference of a centralized server or variable two peers can communicate. P2P is very advantageous for cryptocurrency and the blockchain technology as it promotes decentralization.

18. EXCHANGE

Cryptocurrency exchanges are live trading websites where you can buy a single cryptocurrency or several. There are exchanges that only trade in Bitcoin. Also, there are exchanges which trade a lot of popular cryptocurrencies parallelly.

Some popular exchanges like Coinbase, Kraken, etc., support converting your traditional currency to cryptocurrencies. But some exchanges like Binance only support cryptocurrency to cryptocurrency trading.

There are a lot of cryptocurrency exchanges available for starting your cryptocurrency journey. So it can be tough to decide which one to choose. But once weigh the pros and cons of the popular exchanges, the choice becomes very easy.

For example, you will want to choose a primary exchange to buy a cryptocurrency in exchange for your traditional currency. I suggest giving Coinbase a try – you can buy Bitcoin, Ethereum, and Litecoin on Coinbase. But Coinbase is not available all over the world. In that case, use a popular exchange like Kraken or if you are in India, use Koinex or Zebpay.

But if your motto is to trade cryptocurrencies, you won’t be satisfied with the exchanges I suggested above. For that, you will need an exchange that supports a large number of cryptocurrencies. I suggest using Binance for trading as they have many cryptocurrencies to trade and provide a very responsive platform with negligible fees.

Read – Best Cryptocurrency Exchanges

19. FIAT

You will read and hear the term “fiat” from time to time whenever you are interacting with a cryptocurrency trader. Fiat currency is a fancy way of meaning the traditional currencies we use.

These are government-issued currencies that are controlled by the central banks of the respective countries. Fiat currencies depend on physical assets to determine their values. The central banks can create as much currency as they want, though bound by a few rules. Also, governments control their respective currencies. A fiat currency may lose all its value when the respective government fails or during a political turmoil.

20. MARKET CAP

Market capitalization or market cap, in short, define the total value held in a cryptocurrency. You can easily calculate the market cap of a cryptocurrency by multiplying the total circulating coins to the price of each unit. So if a cryptocurrency has 100 coins and a per coin value of a dollar, the market cap is going to be $100.

Market cap is a great tool to understand the popularity of a cryptocurrency as it gives you useful insights into the cryptocurrency. For example, the most popular cryptocurrency, Bitcoin, has a market cap of $597 billion, crowning it first in terms of market cap.

21. 51% ATTACK

A 51% attack is a deliberate concentrated attack on a cryptocurrency network. This situation arises when an individual or a concentrated group controls more than half of the computing power of an entire cryptocurrency network.

This individual or group can then manipulate the cryptocurrency as they see fit. They can halt the whole cryptocurrency network by halting the mining process. They can also manipulate the blockchain by using singular coins over and over and manipulate all interpersonal transactions.

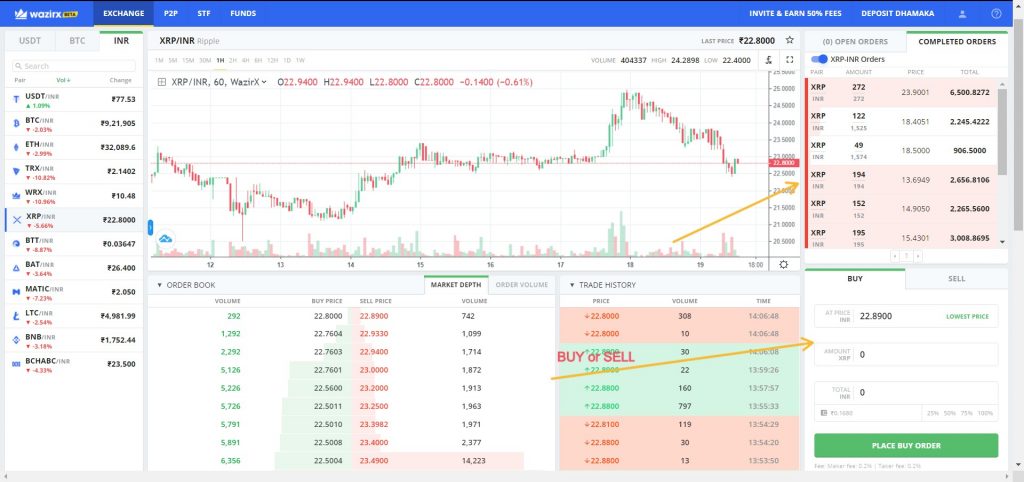

22. ORDERS

Whenever you want to buy or sell some cryptocurrency units you place an order on an exchange. So orders can either be sell orders or buy orders. In the world of cryptocurrencies, orders can be of two types. There are market orders and limit orders.

Market orders are the most basic form of orders. In the case of market orders, you make a purchase or sell your cryptocurrency units at the current market price. For market buy orders, the exchange portal will buy you the coins at the lowest market price. And for market sell orders, the exchange portal will sell your coins at the highest available price.

Limit orders are more advanced as it gives you the freedom to bid your price. You can set the amount per coin as per your liking. And your order will go up in the order queue. Whenever the exchange manages to find any existing order matching your quote, it will automatically complete the order.

Although you get the freedom to quote your own pricing, I advise you not to quote more than 20% higher than the highest order value when selling and vice-versa.

23. ICO

ICO stands for Initial Coin Offering. It is an event where a new cryptocurrency gathers funds or capital before launching. The advantage of ICO over the traditional capital-raising process is that the former is unregulated. So it is easier for a new cryptocurrency project to raise funds without any hassle of paperwork.

In an ICO campaign, a portion of the cryptocurrency is sold to early backers in exchange for another already established cryptocurrency. Most initial coin offering campaigns are currently created on Ethereum because you can easily create smart contracts on Ethereum and use ERC-20 token for your ICO campaign.

SLANG TERMS

Just as I mentioned above, there are a lot of technical as well as slang terms in the world of cryptocurrencies. And you need to know both to converse in the language of cryptocurrency easily.

1. HODL

The term hodl started when a Bitcoin investor drunk-posted on Bitcointalk forum back in 2013. He misspelled the word “hold” in the title of the post. So the titled read “I AM HODLING”.

It started as a meme, but it has become an official term in the cryptocurrency lingo. So don’t get confused when you see the word.

2. FUD

FUD is the abbreviated form of “Fear, Uncertainty, and Doubt”. Cryptocurrency enthusiasts often use this word to describe a baseless negative news or rumor spread by someone. Often times this someone spread this rumor to drop the price of a cryptocurrency. And someone who spreads FUD is termed a FUDster.

USAGE: “Don’t spread FUD about XYZ cryptocurrency. It’s still in good shape.”

3. FOMO

FOMO stands for “Fear of Missing Out”. This term is pretty self-explanatory. It is the overwhelming sensation of getting on the bandwagon before a cryptocurrency blasts off and reaches the moon.

4. PUMP AND DUMP

Pumping is the period when a cryptocurrency gets enough attention and attracts enthusiasts to invest in it. You can easily identify pumping periods from the rapid price increase of a cryptocurrency. You can also anticipate pumping by closely monitoring the cryptocurrency.

Pumping periods are often followed by dumping. Dumping is the period in a cryptocurrency’s life-cycle when it experiences a huge crash.

5. SHILLING

Shilling is the process of advertising a cryptocurrency, more than often a new entrant in the market. This advertising is usually carefully hidden under friendly advice and “insider” news. A “shiller” also promises impractical gains from a cryptocurrency.

FINAL WORDS

I hope you learned something new from this article. I have tried to compile most of the terms used in cryptocurrency society. If you did learn something new, then please let us know in the comment section. It is your continuous support that allows Coinsuggest to grow even more.